Multiple cash flow calculator

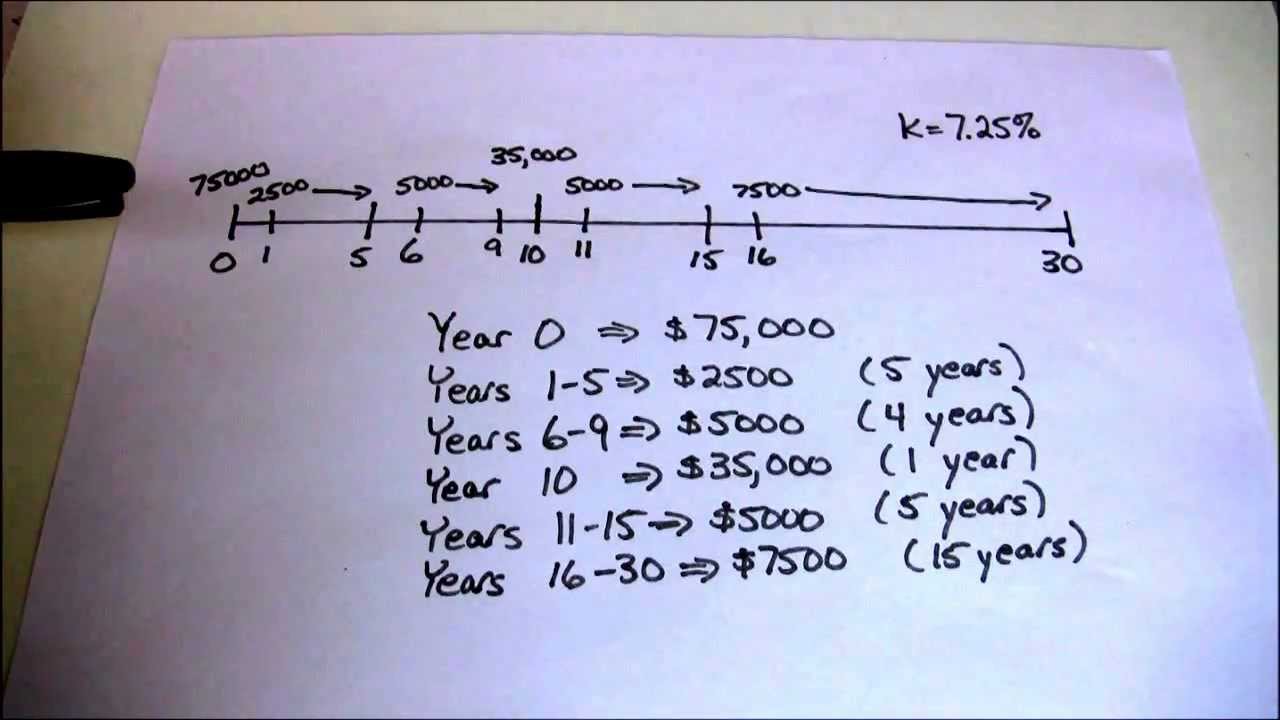

Operating cash flow Net income Non-cash expenses Increases in. Enter the second cash flow of 30 now.

How To Use Discounted Cash Flow Time Value Of Money Concepts

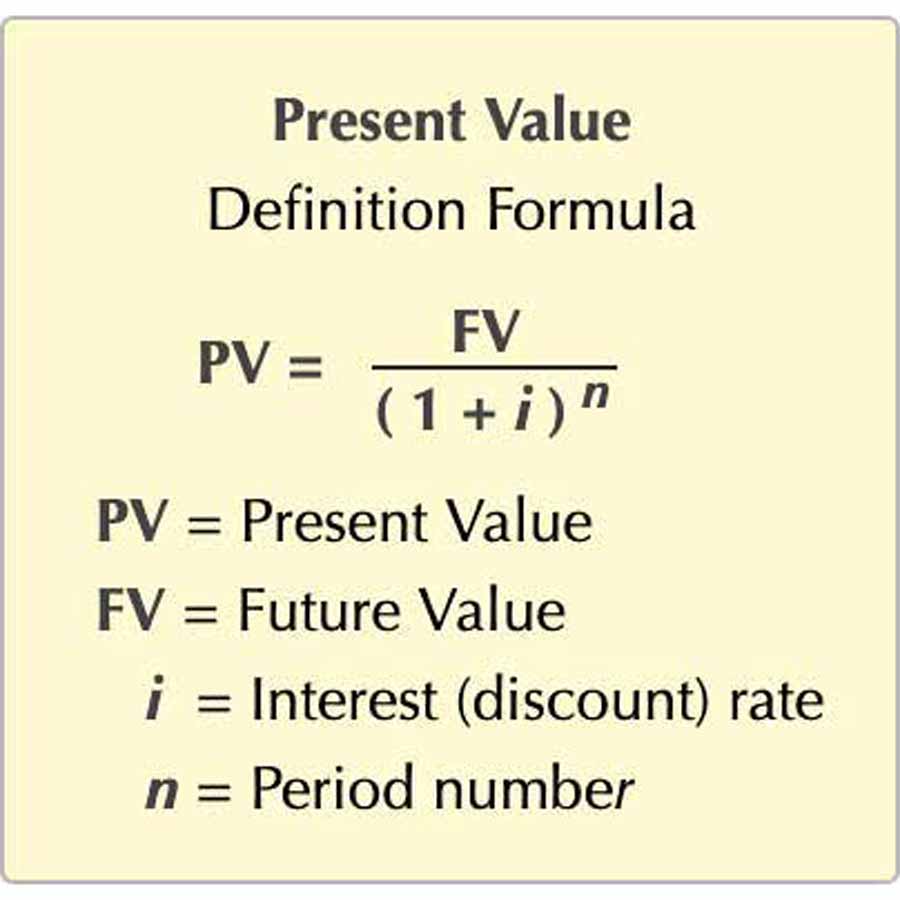

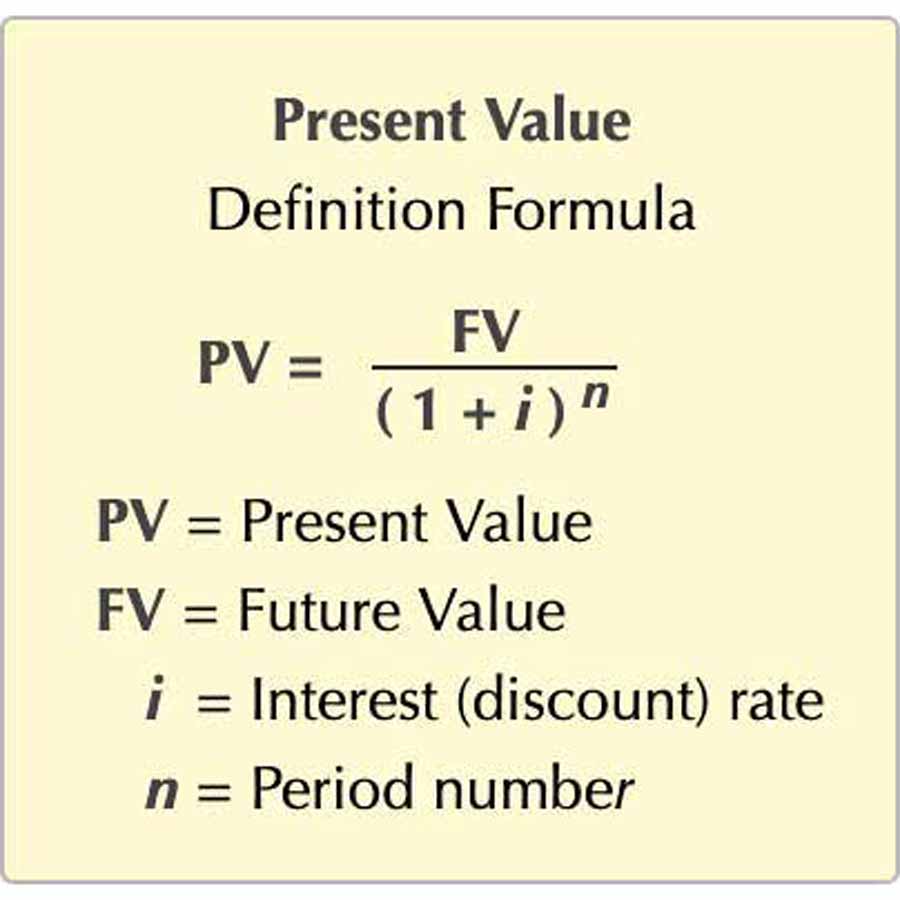

R Discounting Rate.

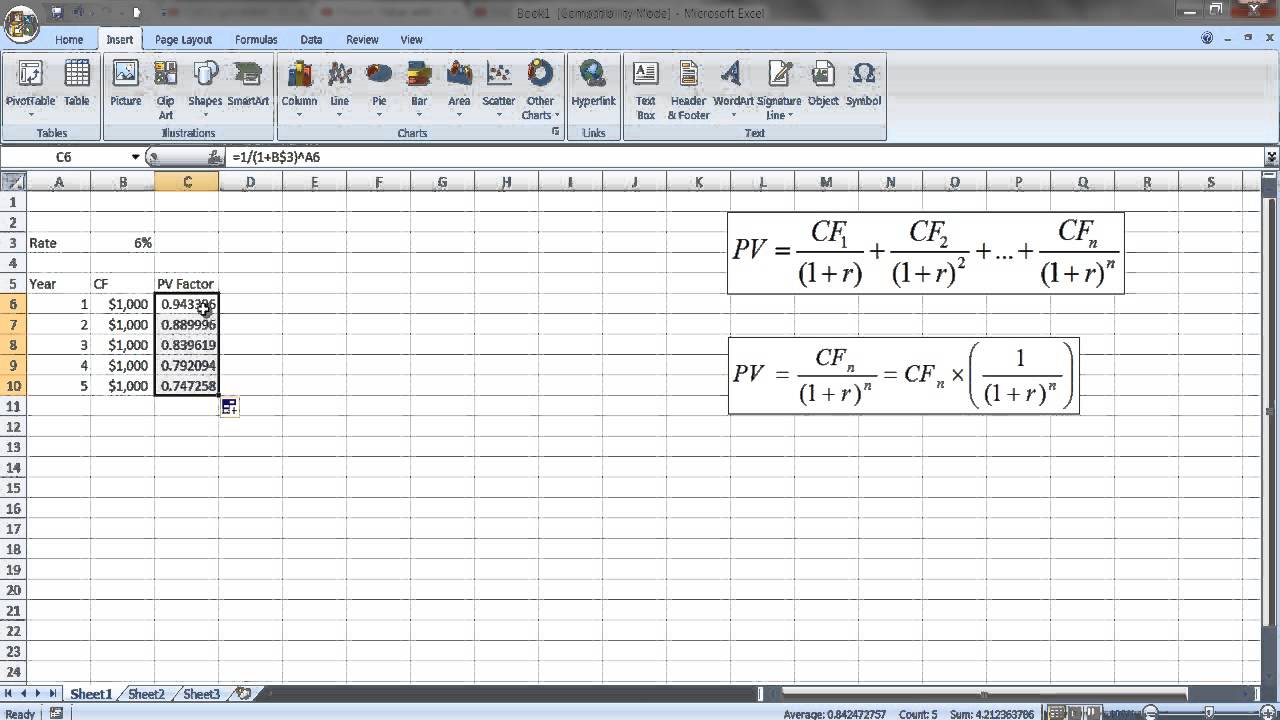

. Year 0 represents the initial investment. We discount our cash flow earned in Year 1 once our cash flow earned in Year 2 twice and our cash flow earned in Year 3 thrice. Integrate book keeping with all your operations to avoid double entry.

The first cash flow at the end of Week 1 is 100 the. The formula for calculating operating cash flow is as follows. May 5 2020 - 1254pm.

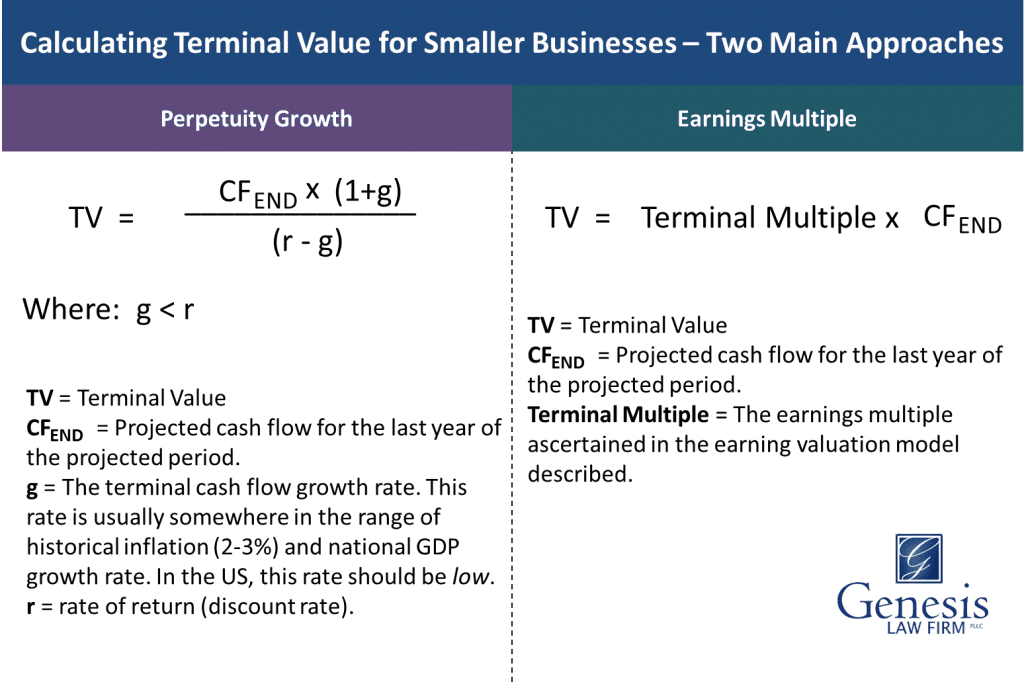

Once we calculate the present value of each cash flow we. Since a cash flow multiple is Value divided by year-ahead Cash Flow the formula becomes CF Multiple 1 k-g. Ad QuickBooks Financial Software.

Try for Free Today. If you run out of available cash you run the risk of not being able to meet your current obligations such as your payroll. Significant improvement for income cash flow type.

Future Value calculation example Let us assume a. PV of Uneven Cash Flows Calculator is. If you run out of available cash you run the risk of not being able to meet your current obligations such as your payroll.

There are three ways to calculate free cash flow. So it looks like 200000 is. You can still calculate the IRR using negative cash flows.

Rated the 1 Accounting Solution. N The period till calculation. Having adequate cash flow is essential to keep your business running.

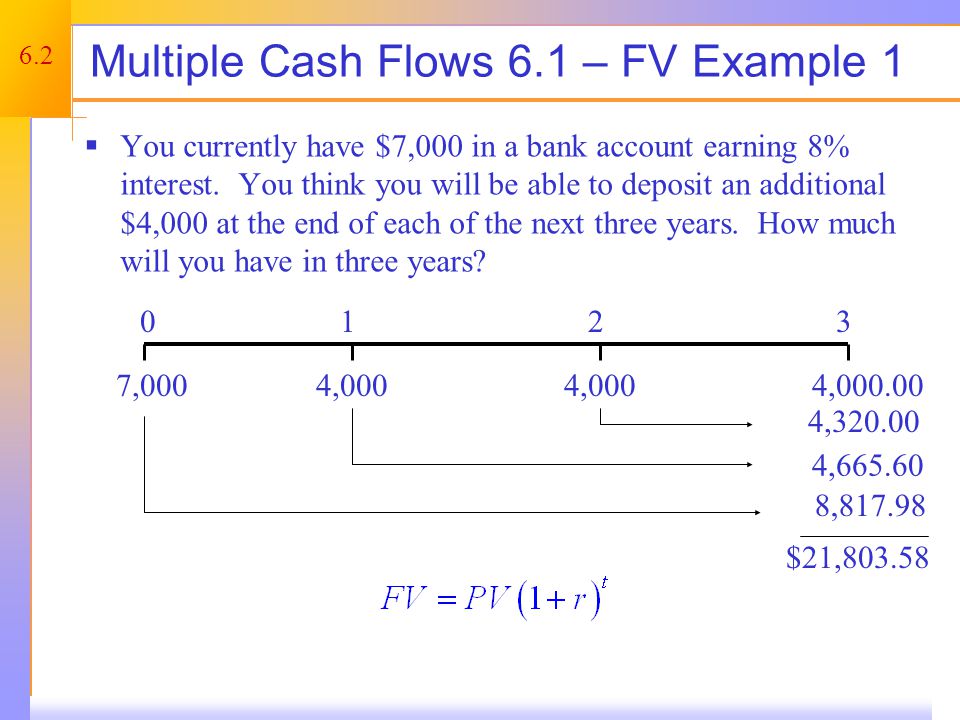

Using operating cash flow using sales revenue and using net operating profits. Having adequate cash flow is essential to keep your business running. To find the future value of multiple cash flows calculate the future value of each cash flow first and then sum them.

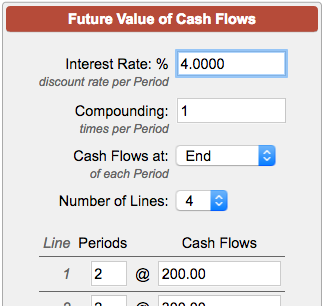

Where CF means Cash Flow for the respective years. Ad Generate clear dynamic statements and get your reports the way you like them. When you enter an annual interest rate it calculates the future value of annuity but it can be used for monthly daily quarterly etc.

Rated the 1 Accounting Solution. What happens when we have multiple periods of different sized cash flows. Since the cash flow of 60 only occurs once we can leave this at the default of 1 by pressing the button The display should now read.

About the Calculator Features. A perpetuity is a constant. Ad QuickBooks Financial Software.

Calculate the future value of each cash flow first and then add them up and compound the accumulated balance forward one year at a time. The future value of a lump-sum of money. We discount the cash flows individually using the equation we just learned.

When Periodic Withdrawal Amount is Unknown and Annual Inflation Rate does not equal 0 the calculator will. The table on the following page illustrates the relationship between the long. Thats why its critical to measure FCF over.

Uneven Cash Flow Streams On The Hp10bii Youtube

Present Value Formula Calculator Examples With Excel Template

Ba Ii Plus Cash Flows 1 Net Present Value Npv And Irr Calculations Youtube

Free Cash Flow Formula Calculator Excel Template

Cfa Exam Calculator Tutorial Multiple Cash Flow Texas Instruments Ba Ii Plus Youtube

Net Present Value Calculator

Cash Flow Valuation Part 4 Of How To Value A Small Business Genesis Law Firm

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

Chapter Outline Future And Present Values Of Multiple Cash Flows Ppt Video Online Download

Ba Ii Plus Fv Of Mixed Cash Flows Youtube

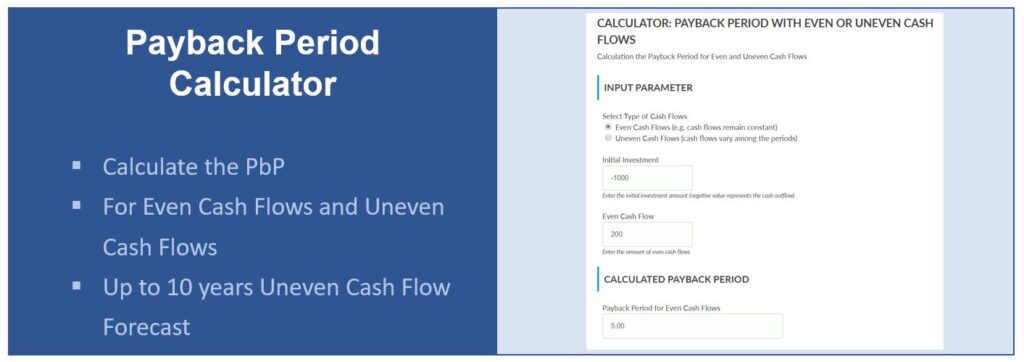

Payback Period Calculator Pbp For Even Uneven Cash Flows Project Management Info

How To Use The Excel Npv Function Exceljet

Solving For Fv Of Uneven Cash Flows Using Baii Plus Youtube

Present Value Multiple Cash Flows In Excel Youtube

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

Future Value Of Cash Flows Calculator

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com